Starting to invest in mutual funds is an important step for your money to grow. In this guide, we’ll look at important strategies and introduce simple apps like mStock with special features that make investing easier.

1. Effortless investing:

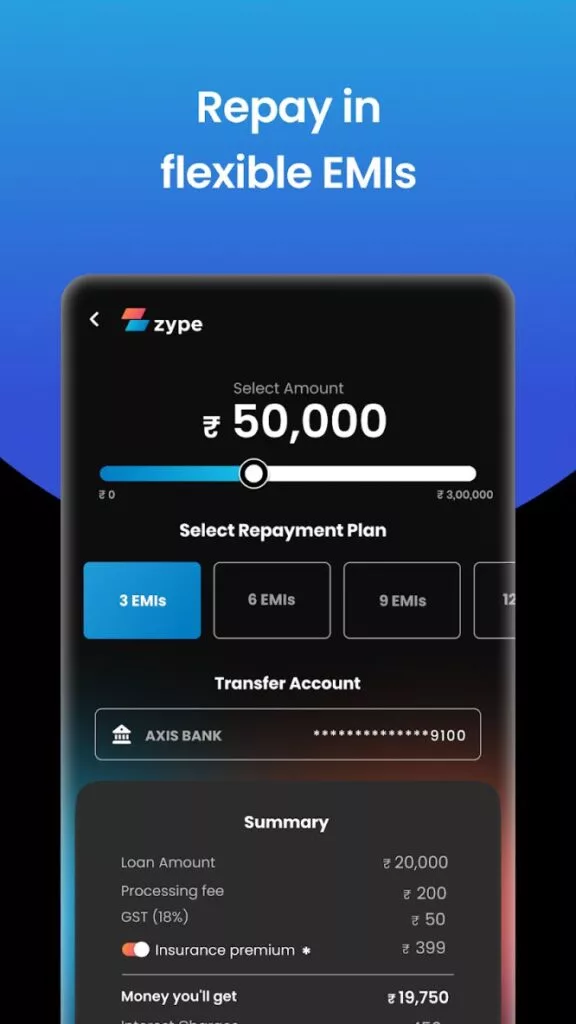

Make investing in mutual funds easy! These easy-to-use platforms, like mStock, let you put money all at once or regularly (SIP) in mutual funds directly, making it simple to grow your wealth without any trouble. Whether you choose to invest in SIP or make lump-sum investments, these platforms offer amazing solutions to help you achieve your financial goals effortlessly.

2. Diverse investment horizons:

Extend beyond mutual funds, exploring a diverse range of investment opportunities, for instance, invest in stocks and IPOs to futures, options, currencies, market-traded funds (MTFs), and equity; apps like mStock provide a comprehensive space for crafting a well-rounded investment portfolio.

3. Intelligent monitoring for informed decisions:

Navigate the markets intelligently with features that include predefined watchlists and price alerts for individual stocks, ensuring you stay informed about market trends and empowering you to make timely investment decisions. Manage your investment portfolio effectively by leveraging these tools to monitor your holdings and seize opportunities in the dynamic market landscape.

4. Analytical power:

For the analytically inclined investor, access advanced charts and indicators, including those for the Nifty stock market. Dive into market data, gaining valuable insights into stock movements and using this information to formulate well-informed and strategic investment strategies.

5. Real-time data at your fingertips:

Stay ahead of market developments with real-time data. Access up-to-the-minute information on market indices, stocks, and contracts, including detailed insights into the option chain. The intuitive investment dashboard simplifies wealth management, providing you with a comprehensive view of your investment landscape.

6. Efficient trading with advanced order options:

Executing trades is made efficient and straightforward with advanced order options. Whether it’s Good Till Triggered (GTT), Basket, Cover, After Market Order (AMO), or more, empower yourself to place orders with a single click.

7. Transparent performance reporting:

Gain insights into your investment performance through detailed reports, including Profit and Loss (P&L), Tax P&L, eMargin ledger, and more. These reports facilitate data-driven decision-making, ensuring transparency in your investment journey.

8. Referral rewards:

As an investor, you can also benefit from a referral rewards program. Refer friends to the apps, and with each successful referral, earn rewards. This not only expands the community but also rewards you for sharing wealth.

In conclusion, these platforms emerge as comprehensive and user-friendly spaces for mutual fund investments. With their unique features, they serve as strategic allies in navigating the world of mutual fund investments. Experience the power of these apps in shaping your financial success.

Imagine you have a sum of money you’d like to invest all at once. These platforms provide a seamless way to do just that. On the other hand, if you prefer a more gradual approach, you can set up a SIP to invest a fixed amount regularly. This ensures a hassle-free and systematic investment experience.

The best part? You don’t have to worry about complicated procedures. With a mere tap or two, you can initiate your investment journey and start growing your wealth without any trouble. The simplicity of these platforms makes it accessible for everyone, whether you’re new to investing or looking for a convenient way to manage your mutual fund portfolio.