Investing in mutual funds through a Systematic Investment Plan (SIP) has become one of the most preferred ways to build long-term wealth. It allows investors to contribute a fixed amount regularly, making it easier to stay disciplined and consistent. For many, understanding the growth of their investments can be confusing — this is where a SIP calculator comes in handy.

A SIP calculator helps estimate the future value of your mutual fund investments based on the amount invested, investment duration, and expected rate of return. Whether you manage your funds through a Demat account or invest directly, this tool helps you make well-informed financial decisions and track your progress toward your goals.

What Is a SIP Calculator?

A SIP calculator is a digital tool designed to estimate how much your mutual fund investment could grow over time. It uses basic financial formulas to calculate the future value of your regular investments by considering three main factors — monthly investment amount, investment period, and expected annual return.

By entering these values, the calculator gives you a clear projection of how your investments may perform. This helps investors plan ahead, analyze their options, and understand how consistent investing can lead to significant wealth accumulation over the years.

How a SIP Calculator Works

When you invest in mutual funds through SIPs, you invest a fixed sum at regular intervals, typically every month. Each installment purchases a certain number of fund units, depending on the fund’s Net Asset Value (NAV) at the time. Over time, your investments grow as the NAV increases, and you also benefit from compounding returns.

The SIP calculator uses the compound interest formula to project your returns:

Future Value (FV) = P × ((1 + r/n) ^ (n × t) – 1) / (r/n)

Where:

- P = amount invested at regular intervals (monthly SIP)

- r = expected annual rate of return

- n = number of investment periods in a year (usually 12 for monthly SIPs)

- t = number of years

The result gives you an approximate value of your investment at the end of the selected period.

Benefits of Using a SIP Calculator

1. Clear Investment Projection

A SIP calculator allows investors to see how their mutual fund investments might perform in the long term. It shows both the total amount invested and the potential returns, helping investors make practical decisions.

2. Simplifies Financial Planning

By using a SIP calculator, you can easily determine how much to invest monthly to reach specific financial goals — whether it’s buying a home, saving for education, or planning for retirement.

3. Encourages Consistency

The calculator visually demonstrates how small, regular investments can grow significantly over time, motivating investors to stay consistent with their SIP contributions.

4. Helps Compare Investment Options

You can use a SIP calculator to compare different mutual fund options and expected returns based on varying rates of return. This helps investors choose funds that align with their risk profile and objectives.

Why Use a SIP Calculator Before Investing

Before starting any investment, understanding the potential outcomes helps build financial confidence. A SIP calculator removes guesswork and provides transparency in planning.

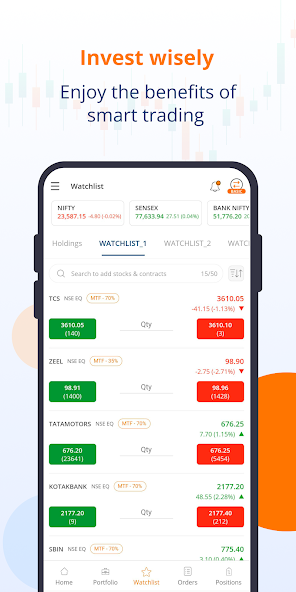

When linked with your Demat account, it becomes even easier to track investments, analyze portfolio growth, and manage multiple mutual fund holdings from one platform. Investors can visualize how their funds are performing and adjust their SIP amounts or investment duration as needed.

The calculator’s predictions are based on compounding, which means your earnings start generating returns over time. This is why early and consistent investing through SIPs often leads to better outcomes compared to lump-sum investments made later.

Steps to Use a SIP Calculator

Step 1: Enter Your Monthly Investment

Decide how much you can invest each month. SIPs allow flexibility — you can start small and increase your contribution as your income grows.

Step 2: Choose the Investment Duration

Select the number of years you want to continue investing. Longer durations generally yield better returns due to compounding.

Step 3: Estimate the Expected Return Rate

Enter an approximate annual return rate based on the mutual fund category. Equity funds typically have higher return potential but come with market risk, while debt funds offer more stability.

Step 4: View Your Future Value

The calculator will display the total investment amount, estimated returns, and overall maturity value. This gives a practical view of how your money grows over time.

Example of SIP Calculation

Suppose you invest ₹5,000 every month in a mutual fund for 10 years at an expected annual return of 12%.

Using the SIP calculator, your total invested amount would be ₹6,00,000. The estimated future value after 10 years would be approximately ₹11,61,000 — a profit of ₹5,61,000.

This simple example highlights how consistent investing, even in small amounts, can generate impressive long-term growth.

Factors That Influence SIP Returns

- Investment Tenure – The longer you invest, the more compounding benefits you gain.

- Return Rate – Market performance directly affects your mutual fund’s growth.

- Investment Frequency – Monthly SIPs help average out market volatility.

- Type of Mutual Fund – Equity, debt, and hybrid funds each have different return potentials and risks.

SIP vs. Lump-Sum Investment

While both methods can build wealth, SIPs have the edge of reducing risk through cost averaging. Instead of investing a large sum at once, SIPs spread your investment across different market conditions, which helps minimize volatility impact.

Investing through SIPs also promotes disciplined saving habits and provides better financial management, especially when linked with a Demat account for organized record-keeping and tracking.

Conclusion

A SIP calculator is an essential tool for anyone planning to invest in mutual funds systematically. It simplifies decision-making, offers clarity about potential returns, and encourages consistent investing. When managed through a Demat account, it becomes easier to monitor and optimize your investment strategy.

By understanding how a SIP calculator works and using it effectively, investors can take confident steps toward achieving their long-term financial goals. Mutual fund investments, when planned and tracked wisely, can be one of the most reliable ways to build wealth over time.