Life is full of dreams, and sometimes these dreams require a money-related boost. Whether it’s seeking after higher education, redesigning your dream space, or taking your family on that long-awaited getaway, turning your dreams into reality can appear like a far-off possibility due to budget limitations. However, here’s where EMI (Equated Monthly Installment) loans step in as the key ingredient to unlock those dreams.

1. Financial Freedom at Your Fingertips:

EMI loans offer you the freedom to materialize your dreams without waiting for years to accumulate the required funds. Loan apps in India provide a reliable and structured approach to attaining your goals. With EMI loans, your aspirations become achievable and within your grasp.

2. Versatile Applications:

EMI loans are versatile. Whether you want to upgrade your car, furnish your home, consolidate existing debts, or cover medical expenses, EMI loans can cater to a wide array of needs. This versatility means that you’re not limited by the type of expenses you can address.

3. Build a Positive Credit History:

When you consistently pay your EMIs on time, you’re actively building a positive credit history. A good credit history can open doors to better monetary opportunities in the future, such as lower interest rates on future loans, better credit card deals, and even improved employment prospects.

4. Achieve Your Dreams Faster:

EMI loans provide you with a shortcut to your dreams. You don’t have to postpone your aspirations for years. With a cash loan app, you can reach your goals sooner, whether it’s furthering your education or launching that new business venture.

5. Emergency Safety Net:

Life is unpredictable, and emergencies can come in our paths at any time. Having a pay later loan app can serve as a financial safety net. With such apps, you can access funds swiftly to deal with unexpected medical claims and bills, car repairs, or any other urgent situation, and defer the repayment to a later date.

6. Retain Your Savings:

Using your savings to fulfill significant financial goals can leave you vulnerable in case of emergencies. EMI loans allow loan instant to preserve your savings while still accessing the funds you need for your projects. This financial prudence ensures you’re prepared for the unexpected.

7. Tax Benefits:

In many cases, EMI loans for specific purposes, like home loans and education loans, come with tax benefits. You can reduce your taxable income, leading to lower tax liabilities, which translates into more savings.

8. Simplified Application Process:

Getting an EMI loan is a straightforward process, especially with the advent of online application systems. This means you can apply for a quick loan from the comfort of your home without lengthy paperwork and in-person meetings.

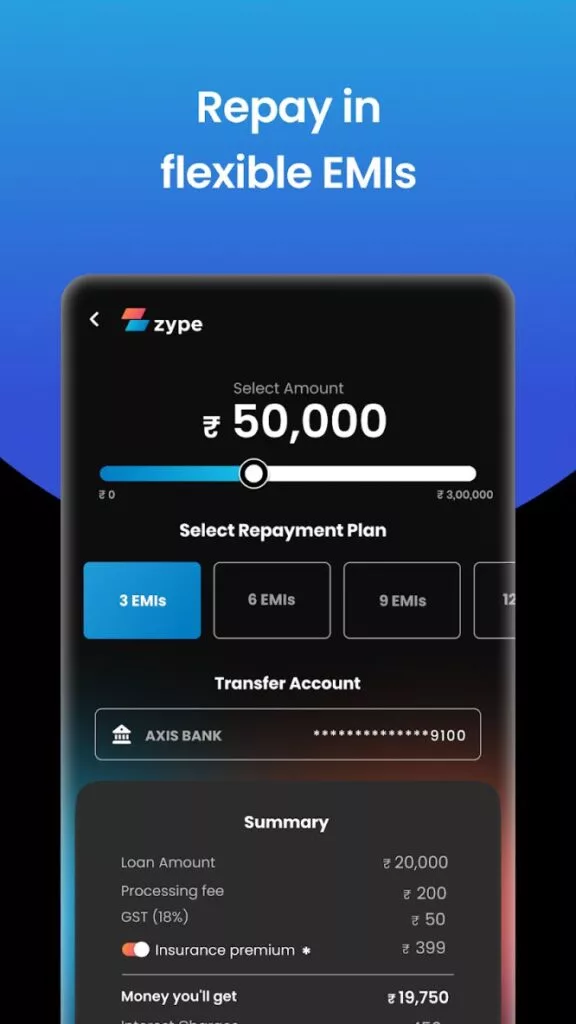

9. Repay on Your Terms:

EMI loans offer flexibility in terms of loan tenure. You can choose the repayment time period that suits your financial situation and early salary, be it short-term for quick repayment or longer-term for lower monthly installments.

Conclusion:

EMI loans are not just a financial product; they are your partners in progress. They empower you to dream big, plan effectively, and secure your financial future without the weight of immediate financial burdens.

With EMI loans, your goals are not just dreams – they are achievable realities. So, why wait? Step forward and embrace the financial freedom EMI loans offer. Your dreams are waiting to be realized, and EMI loans are the optimistic path to make it happen.